does instacart take out taxes for employees

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Taxes for full-service shoppers.

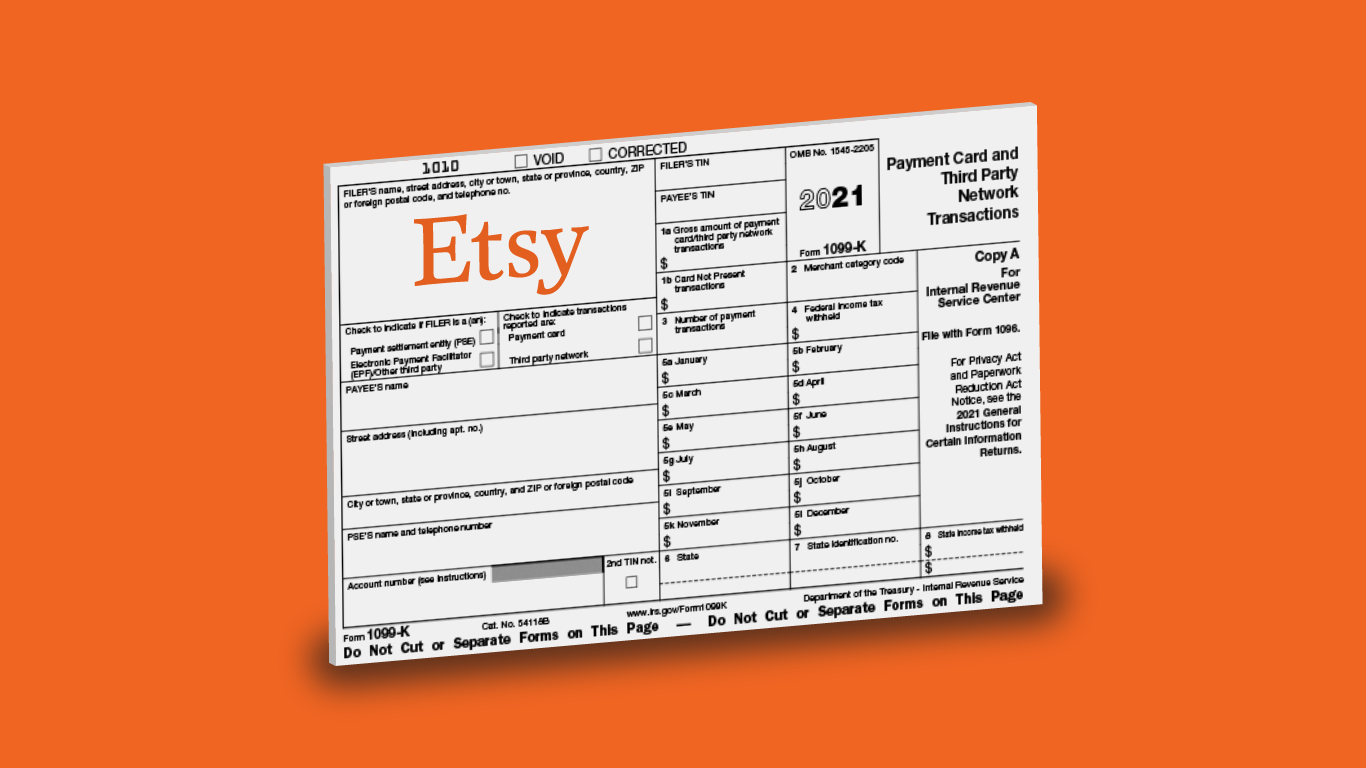

Gig Workers Need To Get Ready For Tax Forms Protocol

Reports how much money Instacart paid you throughout the year.

. Fees vary for one-hour deliveries club store deliveries and deliveries under 35. Part-time employees will have taxes withheld according to the employment laws of their state. Indeed if your earnings in Instacart is above 600 per tax year you will receive a 1099-MISC tax form.

There will be a clear indication of the delivery fee when you are choosing your delivery window. You do get to take off the 50 er portion of the se tax as an adjustment on line 27 of the 1040. Instacart will take care of withholding for them and send them a form W-2 at tax time.

As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart. Yes - in the US everyone who makes income pays taxes. Youll include the taxes on your form 1040 due on april 15th.

Missouri does theirs by mail. You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. Since youre an independent contractor and classified as a sole proprietor you qualify for the Section 199A Qualified Business Income deduction.

This includes self-employment taxes and income taxes. IRS deadline to file taxes. If you are looking for a hands-off approach to dealing with your Instacart 1099 taxes try Bonsais 1099 expense tracker to organize your tax deductions online.

This is a standard tax form for contract workers. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour. You wont send this form in with your tax return but you will use it to figure out how much business income to report on your Schedule C.

Instacart full-service shoppers also need to pay full Social Security and Medicare taxes also called self-employment taxes. That means youd only pay income tax on 80 of your profits. As always Instacart Express members get free delivery on orders 35 or more per retailer.

About half of all jobs and half of all weekly earnings reports show pay thats below. Estimate what you think your income will be and multiply by the various tax rates. For tax purposes theyll be treated the same as anyone working a traditional 9-to-5.

Except despite everything you have to put aside a portion of the. Our analysis of more than 1400 samples of pay data provided by Instacart workers across the country finds that the average Instacart worker is paid just 766hour after accounting for the costs of mileage and additional payroll taxes borne by independent contractors. Do not receive a w2 from Instacart.

Please dont submit any personal information. You pay 153 SE tax on 9235 of your Net Profit greater than 400. Help job seekers learn about the company by being objective and to the point.

Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. Instacart contracts checkr inc to perform all shopper background checks. To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account.

Deductions are important and the biggest one is the standard mileage deduction so keep track of. Does Instacart Take Out Taxes For All Employees. Youll need your 1099 tax form to file your taxes.

Does Instacart deduct taxes. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Does Instacart take out taxes.

Side note Im an idiot who didnt want to pay taxes out of pocket so I canceled 10 Instahours and decided to Instaquit. You can even write-off from your taxes the cost of hiring a tax professional if needed - this is optional if you seek out tax advice but highly recommended. For gig workers like instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year.

Should I just save half of my pay. The exception is if you accepted an employee position. When you work for instacart youll get a 1099 tax form by the end of january.

It depends on your classification. One they dont want to wait until April 15 to spend our money. For simplicity my accountant suggested using 30 to estimate taxes.

For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. How do I update my tax information. Your answer will be posted publicly.

When youre an employee your employer contributes 765 toward those taxes and withholds the other 765 from your pay. If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes.

Where is Instacart located. This is because the irs does not require instacart to issue you a form if. All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year.

This form works for all. - Intentional property damage or vandalism of any kind. Instacart delivery starts at 399 for same-day orders 35 or more.

In-store shoppers are classified as Instacart employees. Instacart will file your 1099 tax form with the IRS and relevant state tax authorities. Does Instacart take out taxes for its employees.

Its a completely done-for-you solution that will help you track and. Instacart doesnt take taxes out because its a contractor job which is understandable but what do yall do around tax season. Fortunately you can still file your taxes without it and regardless of whether or not you receive a.

- Unwanted physical contact or sexual conduct of any kind involving contractors retail employees or Instacart employees while receiving services. If you work as an in-store shopper you can stop reading this article right here. The other is if they dont take it out early we are too likely to spend it before April 15 and now they have to work harder to GET our money.

Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. As an independent contractor you must pay taxes on your Instacart earnings. Please note that all of this content is user-generated and its accuracy is not guaranteed by Indeed or this company.

You can review and edit your tax information directly in. This can make for a frightful astonishment when duty time moves around. The Instacart app should not be used to communicate for issues other than order items the status of an order or the manner of delivery.

This is for two reasons. Independent contractors are responsible for filing their own taxes and many choose to do so quarterly to prevent a big lump sum being owed at the end of the year. What do yall do about taxes.

No they do not. It doesnt take long to learn that the government takes money out of your check right away when you are an employee. The estimated rate accounts for Fed payroll and income taxes.

W5 Form Look Up 5 Outrageous Ideas For Your W5 Form Look Up W2 Forms Tax Forms Power Of Attorney Form

Instacart Taxes The Complete Guide For Shoppers Ridester Com

How Much Of My Earnings Doordash Grubhub Uber Eats Etc Is Taxable

What Can I Write Off On My Taxes For Instacart Taxestalk Net

What You Need To Know About Instacart Taxes Net Pay Advance

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart Taxes Net Pay Advance

The Best Guide To Paying Quarterly Taxes Updated For 2021

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

How To File Taxes As An Independent Contractors H R Block

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Turbotax Home Business 2021 Tax Software Federal And State Returns Federal E File State E File Additional Pc Download E Delivery Costco

Does Instacart Take Out Taxes In 2022 Full Guide

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide